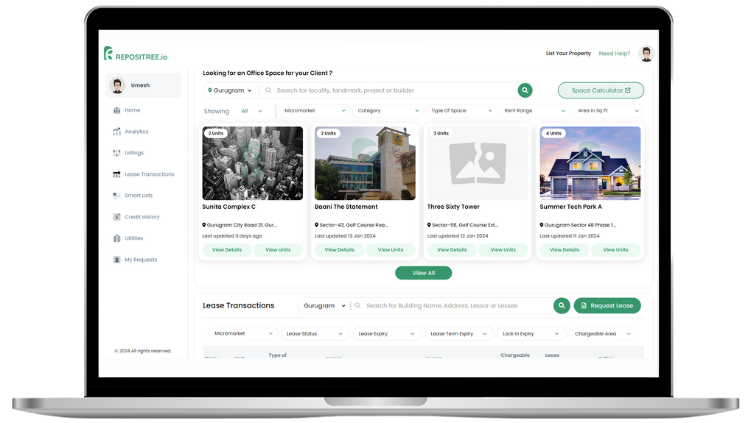

Maximizing the value of commercial real estate (CRE) properties is essential for investors and property owners looking to improve their returns. Implementing smart value-add strategies can significantly boost property value and increase profitability. In this guide, we’ll explore five key strategies that can help you enhance your property’s performance in a competitive market.

5 Value-Add Strategies to Boost Property Value in CRE

Renovate and Upgrade Property Features

One of the most straightforward ways to increase property value is by modernizing and upgrading essential property features. Focus on critical areas like the HVAC system, plumbing, and electrical infrastructure to enhance the property’s operational efficiency. Additionally, upgrading the property’s aesthetics—such as repainting, landscaping, and updating lighting—can improve its visual appeal, attracting higher-paying tenants.

Increase Occupancy Rates

A well-occupied building generates consistent income, which directly impacts the property’s value. To boost occupancy rates, implement creative marketing strategies and offer incentives, such as free rent for the first month or reduced move-in fees. Optimize the layout and space usage to make the property more attractive to a diverse range of tenants, ensuring that all leasable units are filled.

Reduce Operating Costs

Reducing operating expenses directly improves the property’s net operating income (NOI). Upgrade the property to more energy-efficient systems, such as installing LED lighting, solar panels, and smart thermostats. Renegotiate contracts with service providers to get better rates, and implement regular maintenance schedules to avoid costly repairs.

Reposition the Asset

Repositioning involves changing the property’s use or branding to attract new types of tenants. For example, you could transform an underutilized office space into a co-working hub or revamp common areas to improve the tenant experience. Rebranding or appealing to a different market segment can make your property more attractive, boosting both demand and occupancy rates.

Leverage Financial Restructuring

Maximizing property value isn’t just about physical improvements. Financial restructuring can also help you increase returns. Refinance existing loans at lower interest rates or explore creative financing options like seller financing or mezzanine loans. Profits from these adjustments can be reinvested into additional value-add projects, leading to compound growth over time.

Renovate and Upgrade Property Features

One of the most straightforward ways to increase property value is by modernizing and upgrading essential property features. Focus on critical areas like the HVAC system, plumbing, and electrical infrastructure to enhance the property’s operational efficiency. Additionally, upgrading the property’s aesthetics—such as repainting, landscaping, and updating lighting—can improve its visual appeal, attracting higher-paying tenants.

Increase Occupancy Rates

A well-occupied building generates consistent income, which directly impacts the property’s value. To boost occupancy rates, implement creative marketing strategies and offer incentives, such as free rent for the first month or reduced move-in fees. Optimize the layout and space usage to make the property more attractive to a diverse range of tenants, ensuring that all leasable units are filled.

Reduce Operating Costs

Reducing operating expenses directly improves the property’s net operating income (NOI). Upgrade the property to more energy-efficient systems, such as installing LED lighting, solar panels, and smart thermostats. Renegotiate contracts with service providers to get better rates, and implement regular maintenance schedules to avoid costly repairs.

Reposition the Asset

Repositioning involves changing the property’s use or branding to attract new types of tenants. For example, you could transform an underutilized office space into a co-working hub or revamp common areas to improve the tenant experience. Rebranding or appealing to a different market segment can make your property more attractive, boosting both demand and occupancy rates.

Leverage Financial Restructuring

Maximizing property value isn’t just about physical improvements. Financial restructuring can also help you increase returns. Refinance existing loans at lower interest rates or explore creative financing options like seller financing or mezzanine loans. Profits from these adjustments can be reinvested into additional value-add projects, leading to compound growth over time.